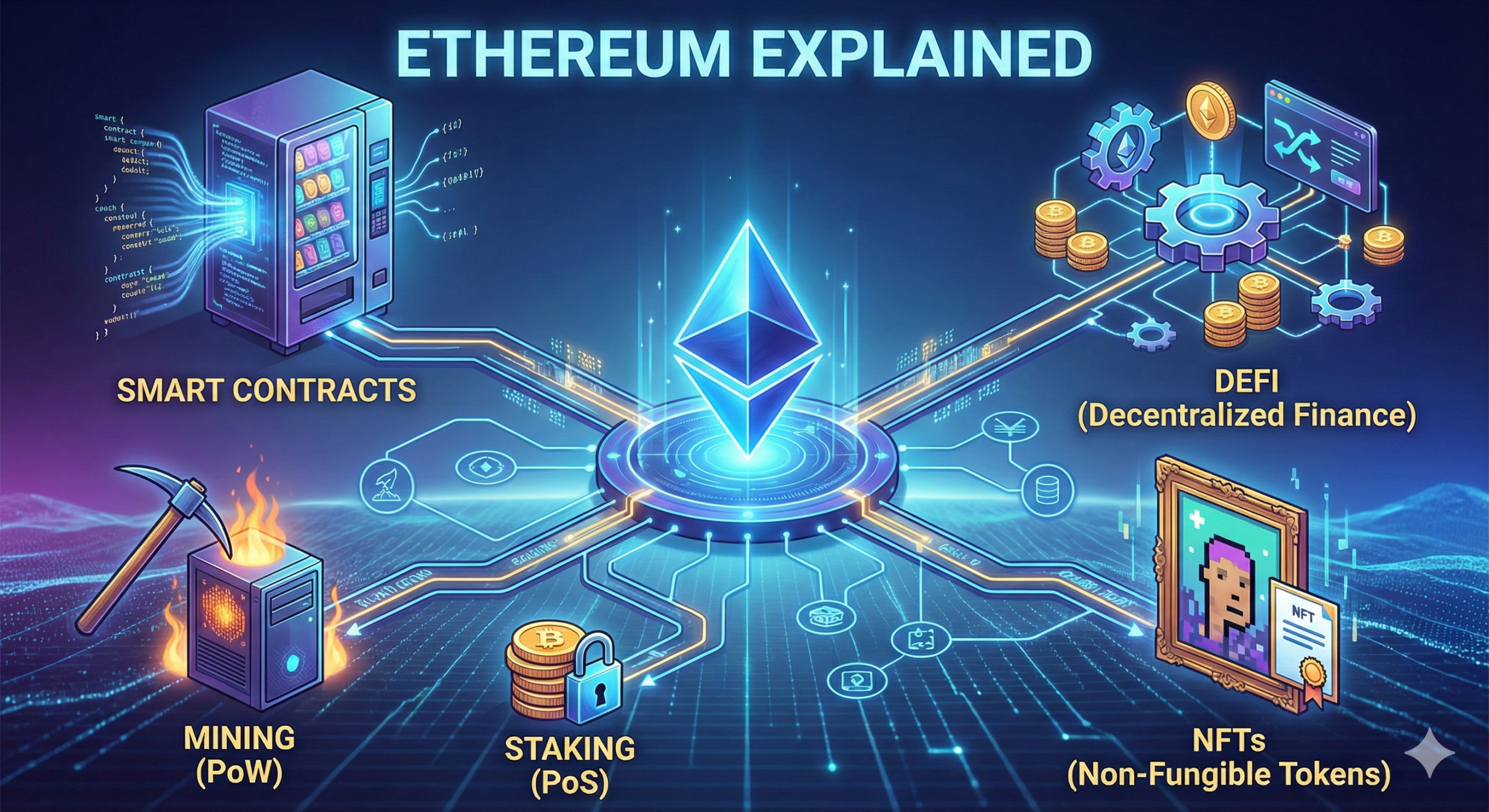

Smart Contracts, DeFi, NFTs, Mining & Staking

If you’ve heard of Ethereum but still don’t understand how it works, you’re not alone. In this book, we break down Ethereum in simple terms, covering smart contracts, DeFi, NFTs, mining, and staking, so that anybody can comprehend the fundamentals of this powerful blockchain ecosystem.

What Is Ethereum?

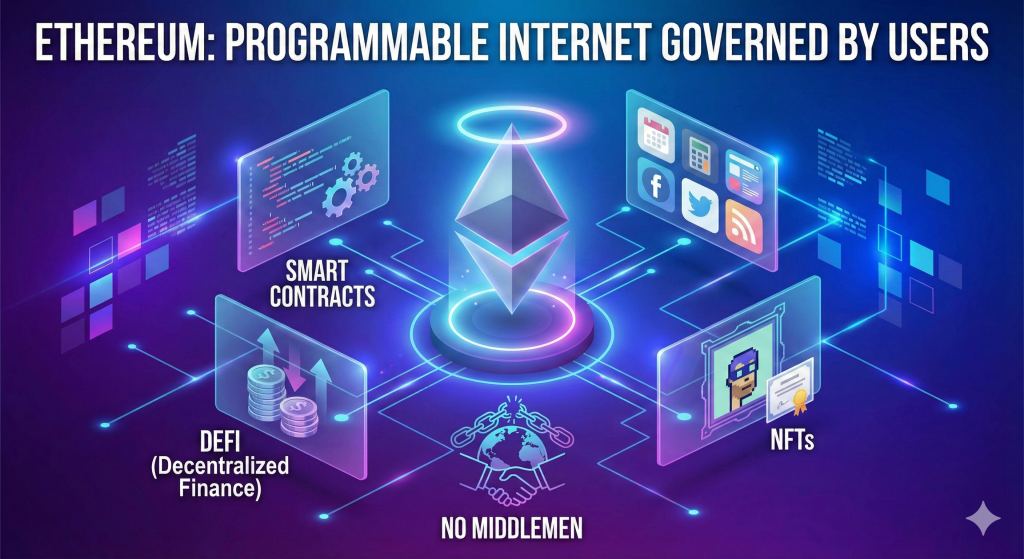

Ethereum is a blockchain platform that introduced smart contracts, which are pieces of code that execute automatically when certain circumstances are satisfied. These smart contracts enable decentralized apps (dApps), decentralized financing (DeFi), NFTs, and much more.

Because Ethereum eliminates the need for middlemen, it allows for a more open, programmable internet governed by users rather than central authorities.

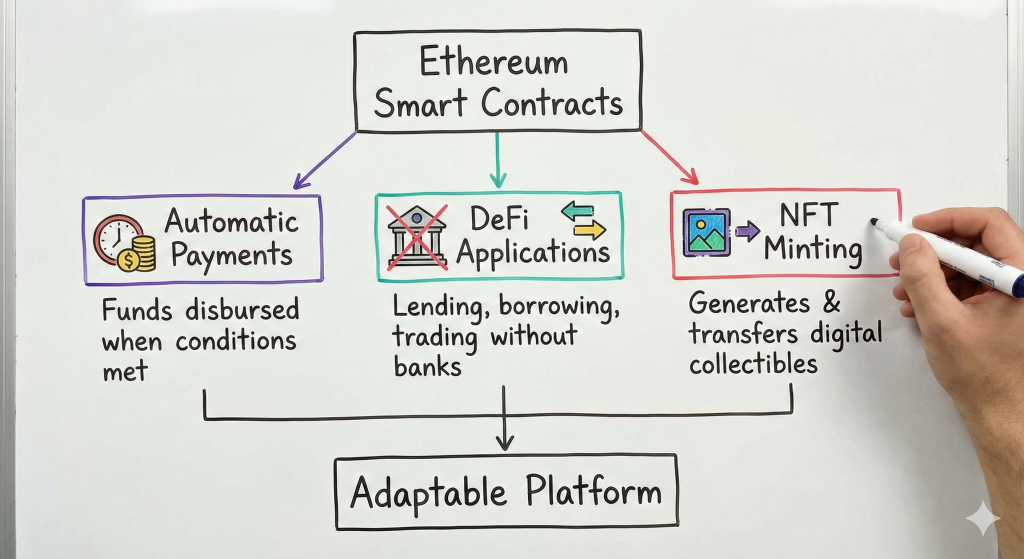

What Are Smart Contracts?

Smart contracts are automatic digital agreements based on the blockchain. Once deployed, they operate independently of banks, attorneys, and third-party approval.

Real-world examples of smart contracts

- Automatic payments disburse funds when certain conditions are met.

- DeFi applications: lending, borrowing, and trading without banks.

- NFT minting: automatically generates and transfers digital collectibles.

These contracts make Ethereum one of the most adaptable platforms in the cryptocurrency world.

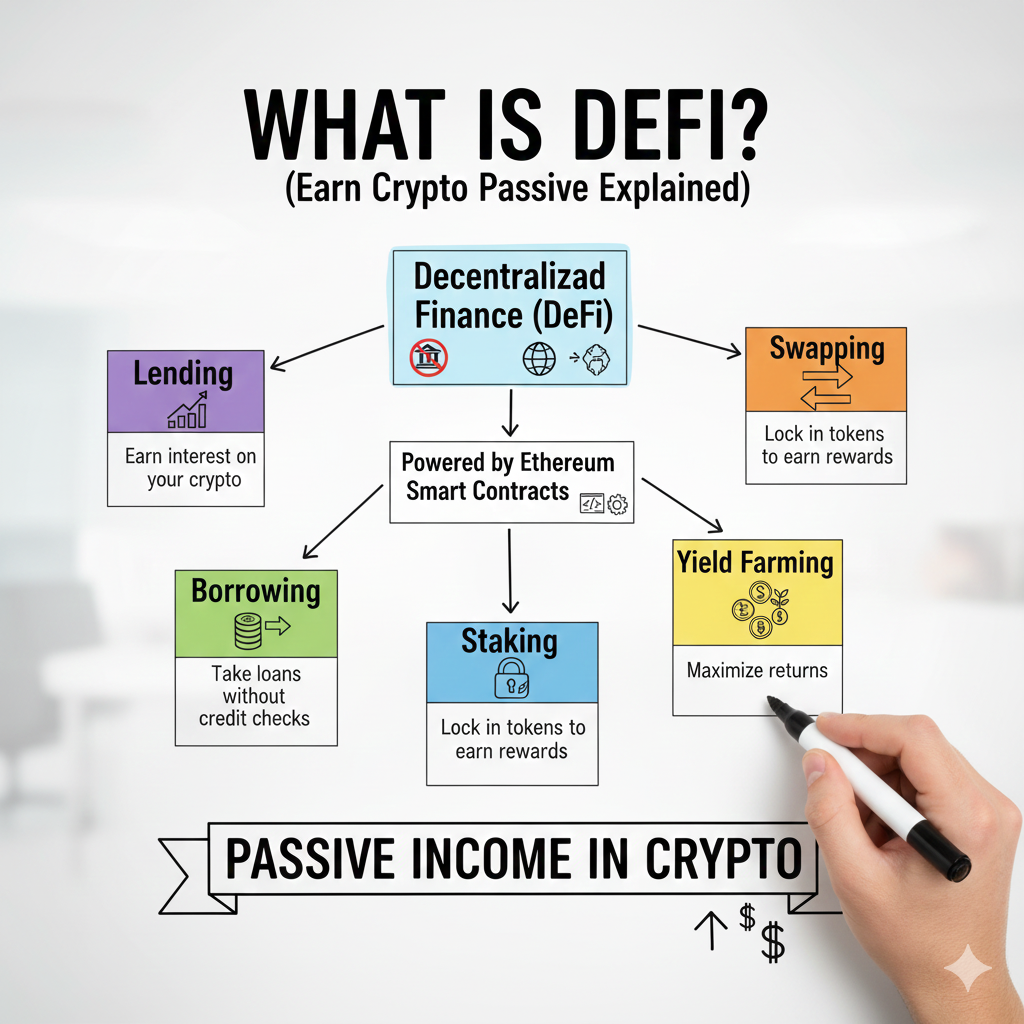

What Is DeFi? (Decentralized Finance Explained)

DeFi, or decentralized finance, is a term used to describe financial services that do not include banks or intermediaries. Everything is enabled by Ethereum smart contracts, which make transactions faster, cheaper, and globally accessible.

Common DeFi Activities

- Lending: Earn interest on your cryptocurrency.

- Borrowing: Take loans without credit checks.

- Staking: involves locking in tokens to receive benefits.

- Swapping: trading tokens instantly

- Yield farming: maximizes returns by transferring liquidity between protocols.

For many people, DeFi is a means to get passive income in cryptocurrency.

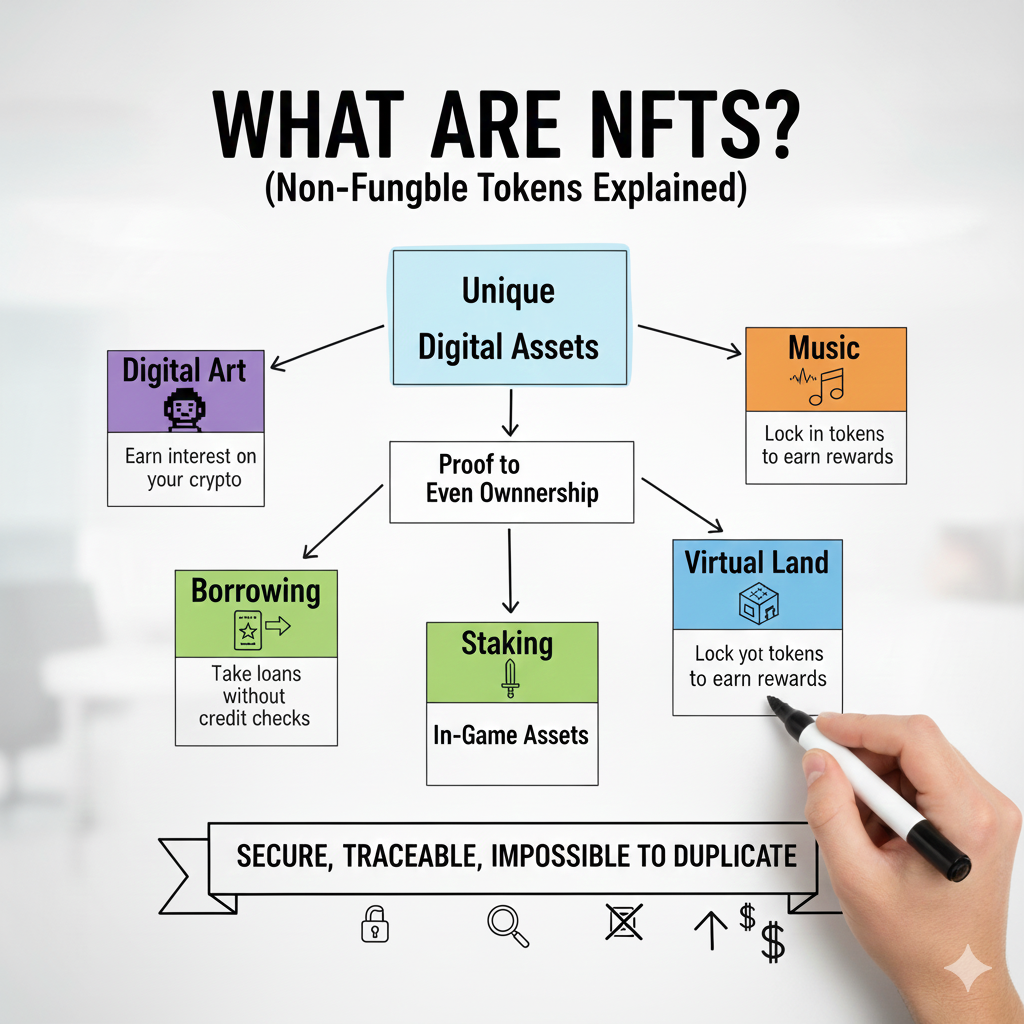

What Are NFTs? (Explained Simply)

NFTs (non-fungible tokens) are unique digital assets that prove ownership of things like:

- Digital art

- Music

- Collectibles

- Virtual land

- Identity items

- In-game assets

Each NFT is stored on the blockchain, making it secure, traceable, and impossible to duplicate.

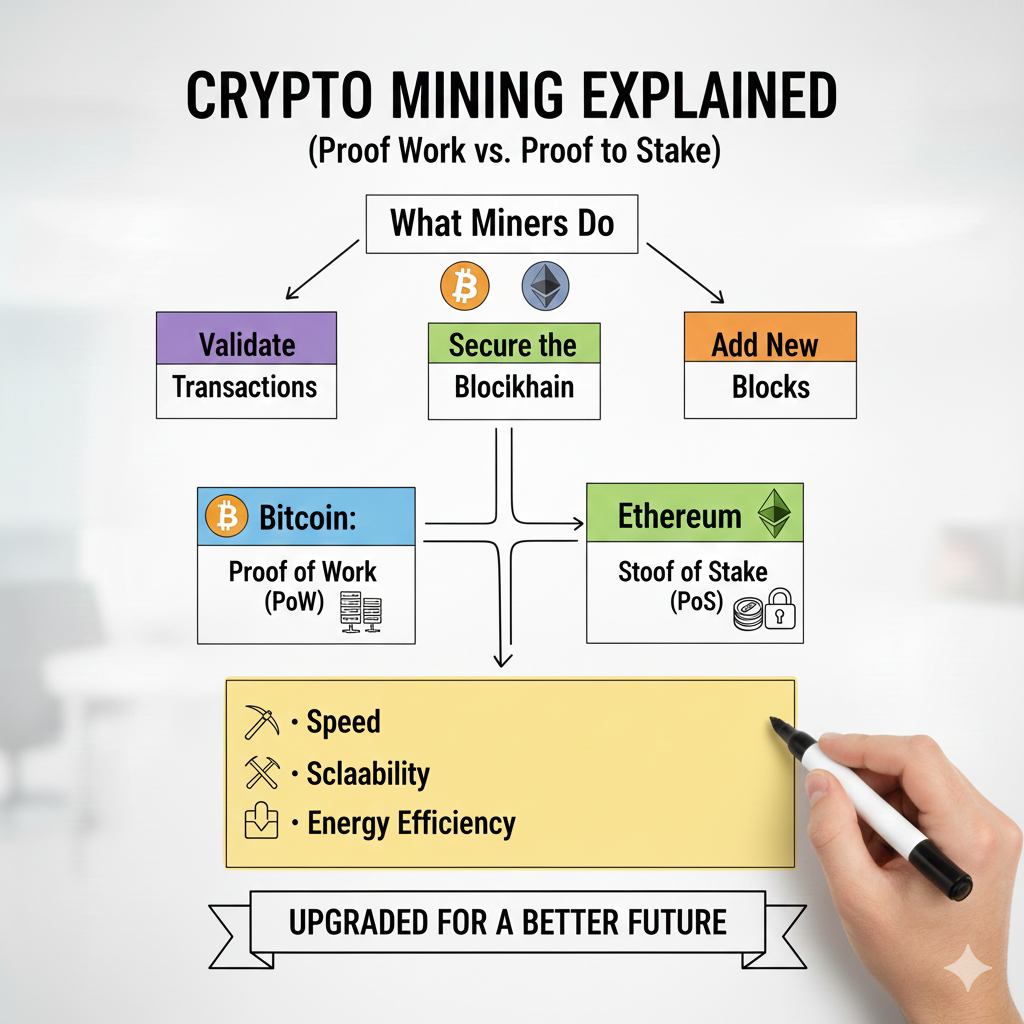

Crypto Mining Explained

Ethereum used to function similarly to Bitcoin before adopting proof-of-stake technology.

What do miners do?

- Validate transactions.

- Secure the blockchain.

- Add new blocks into the network.

Bitcoin still employs Proof of Work (PoW) mining, whereas Ethereum has switched to Proof of Stake (PoS) for increased speed, scalability, and energy efficiency.

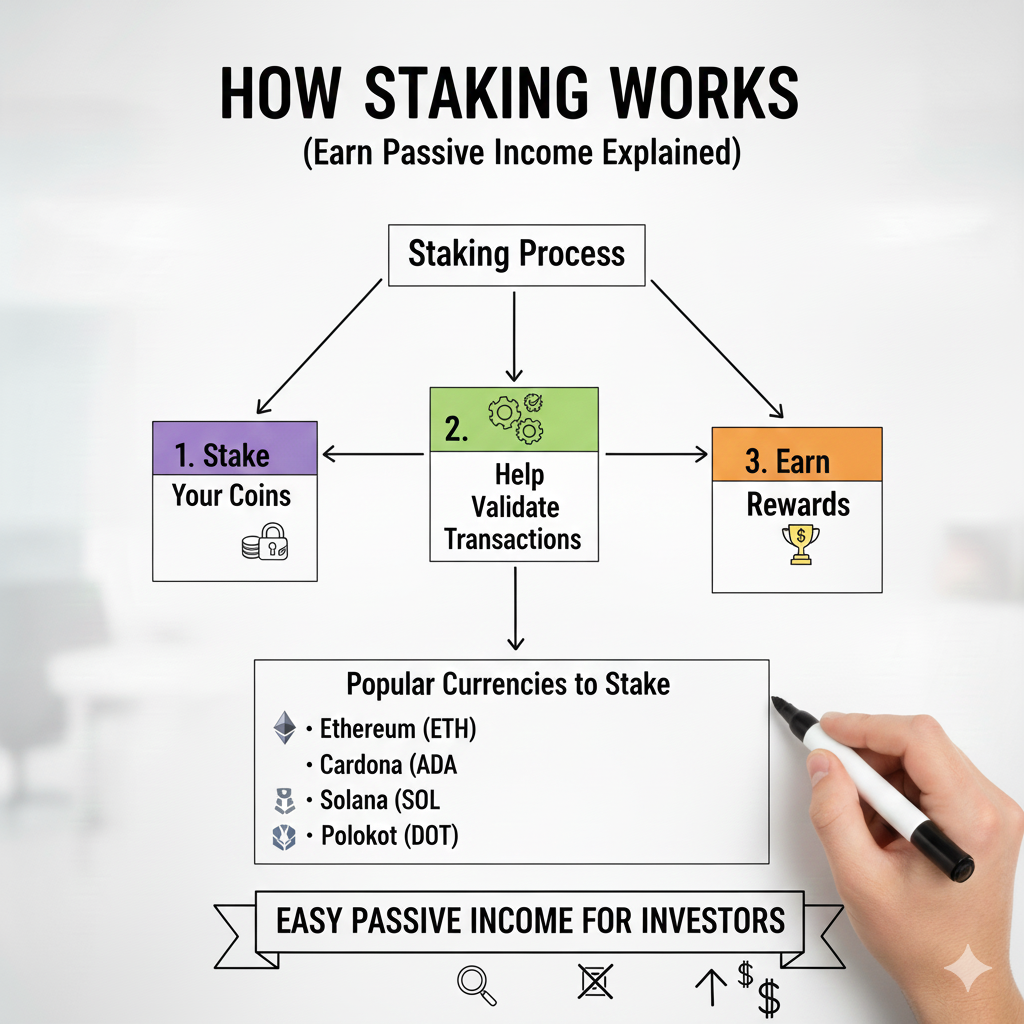

How Staking Works (Earn Passive Income)

Staking is the new way Ethereum and many other blockchains maintain security.

How staking works.

- Stake your coins.

- Help validate transactions.

- Earn awards by helping the network.

Popular currencies to stake

- Ethereum (ETH)

- Cardano (ADA)

- SOL (Solana)

- Polkadot (DOT)

Staking is one of the simplest ways for cryptocurrency investors to generate passive income.

Ethereum's ecosystem, which includes smart contracts, DeFi, NFTs, and staking, is altering the way we design applications and manage money online. Whether you're new to cryptocurrency or want to expand your expertise, knowing Ethereum is a great place to start.